XRP is the virtual token developed by cryptocurrency exchange, Ripple. It is considered as the third most famous cryptocurrency in the world.

XRP has a market capitalization of over $12.5 billion, and it ranks merely behind Bitcoin and Ethereum in terms of total market value.

XRP is viewed as a standout in the top six virtual currencies of CoinMarketCap.

It is because, besides the well-known stablecoin, Tether, it is the sole digital coin that is not based on a permission-less blockchain technology that leverages proof-of-work.

This reality about Ripple’s virtual token makes it possess an impressive accomplishment for a cryptocurrency that does not have miners.

Furthermore, XRP presents itself nearly exclusively as a settlement coin for the financial industry.

The entire 2019 appeared to be challenging for XRP, with cryptocurrency traders finding it difficult to bag gains.

Trading Performance of Ripple’s Token in the Second Quarter of 2019

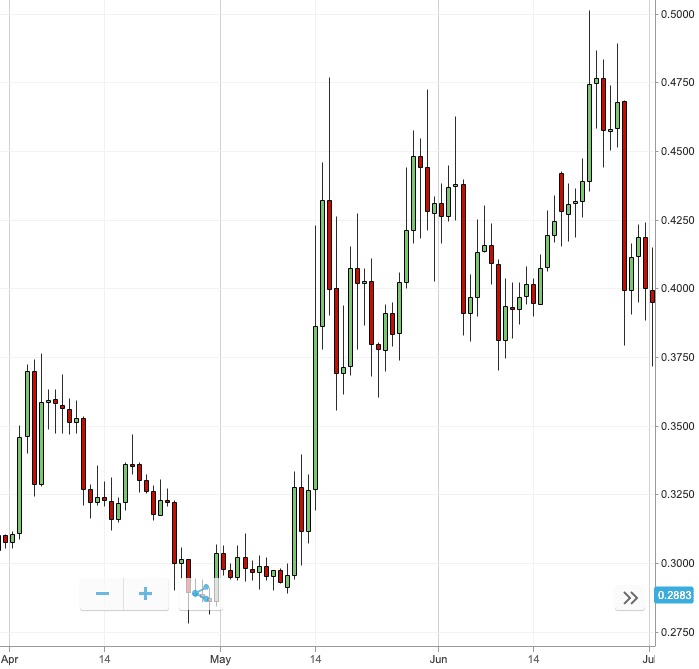

During the second quarter of the year, XRP’s performance was similar to the other significant cryptocurrencies at the start.

The digital currency opened at $0.3105, and it nearly jumped to $0.3457 right away within one day.

After a short increase to $0.375, XRP spent the rest of April and the middle of May consolidating well in the south of $0.30.

Then, it presented strength, with its price surging to an impressive $0.45.

In June, the XRP market tread between $0.375 and $0.475, closing the second quarter rebounding, and even managing a brief increase to $0.50.

XRP concluded the second quarter of 2019 at approximately $0.40, but only to let go of the gains it made during the period’s second half.

How Ripple’s Cryptocurrency Fared in the Third Quarter of 2019

The third quarter of 2019 was bleak for Ripple’s cryptocurrency, just like the other virtual currencies in the market.

XRP began the quarter at $0.40, yet eventually plummeting south of $0.27.

By the final week of the third quarter, XRP’s trading price swung from below $0.225 to a slight recovered figure of $0.25.

Positive and Negative Developments for Ripple’s Token

Aside from the dismal trading performance of XRP, other news regarding Ripple displayed a discouraging picture.

Ripple Labs formally requested the US Federal Court to dismiss a class-action lawsuit that accused the cryptocurrency entity of unlawfully selling unregistered securities.

Nevertheless, not every event for the year was unsightly for Ripple.

Xpring, the collaborative initiative of Ripple Labs, granted one billion XRP, or $250 million, to Coil Technologies, Incorporated, a micropayments company serving content providers.

The initiative will reportedly aid in fostering the adoption of the XRP. Furthermore, Ripple Labs acquired Algrim, a cryptocurrency trading company based in Iceland.

This development for Ripple is reportedly the most well-received news, as it marks the cryptocurrency exchange’s official expansion in the Nordic island nation.

Moreover, this feat led to the addition of six engineers to the team of Ripple, and they will be helping on the development of the cryptocurrency exchange’s liquidity offerings.

Finally, news circulated recently about Bank of America silently piloting Ripple technology, which is seen as a promising development for the company and its virtual token.

October started with XRP’s trading price rising approximately $0.05 from just above $0.24 to $0.2870. It shows that the cryptocurrency is performing relatively well.

However, considering the consistent minimal to zero uptrends it encountered, Ripple’s cryptocurrency would not see itself ending the year on a high.